Bitcoin is currently holding just above the $108,000 level and bulls are maintaining momentum after a volatile start to July. However, a closer look at on-chain data shows how fragile that position might be.

Interestingly, two support levels, $106,738 and $98,566, are now the most important zones for bulls to defend. These levels represent clusters of addresses holding large amounts of Bitcoin, and losing them could trigger a deeper correction.

Related Reading

Bitcoin’s Support Clusters Around $106,000 And $98,000

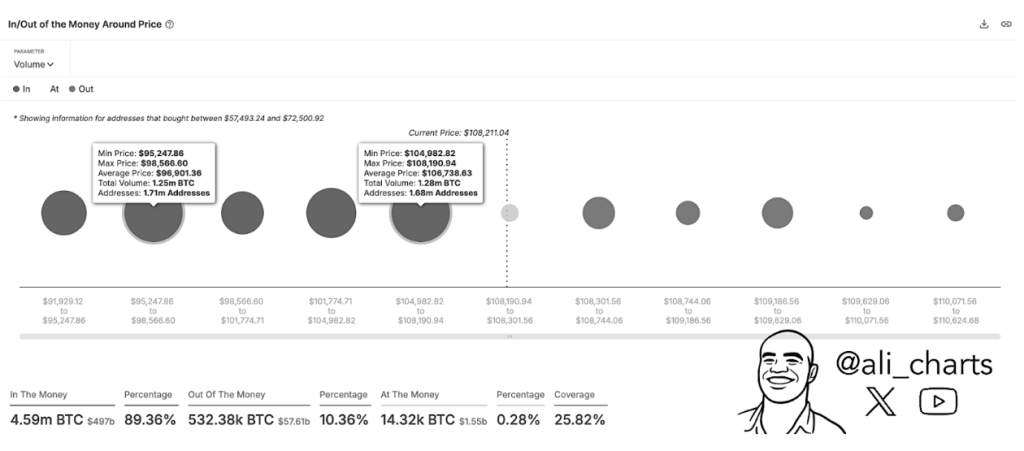

Taking to the social media platform X, crypto analyst Ali Martinez pointed to two major support levels based on data showing Bitcoin’s purchase clusters. This data is based on Sentora’s (previously IntoTheBlock) In/Out of the Money Around Price metric among addresses that bought Bitcoin close to the current price.

As shown by the metric, the most important current zones of purchase are at $106,738 and $98,566. These two zones are where massive buying activity has occurred in the past few weeks, and they could act as support in case of a Bitcoin price crash.

The first zone, between $104,982 and $108,190, contains 1.68 million addresses with a total volume of 1.28 million BTC at an average price of $106,738. Below the first zone, a larger group of 1.71 million addresses holds a greater volume of 1.25 million BTC within the price range of $95,248 to $98,566, with an average price of $98,566.

As long as Bitcoin continues to trade above these levels, the ongoing rally could continue to push upward. However, if these pockets of demand are broken with enough selling pressure, the leading cryptocurrency could enter into an uncertain price zone with little buying interest to provide support.

Speaking of selling pressure, on-chain data shows a slowing sell pressure among large holders. According to data from on-chain analytics platform Sentora, Bitcoin recorded its fifth straight week of net outflows from centralized exchanges. The past week alone saw more than $920 million worth of BTC moved into self-custody or institutional products, mostly Spot Bitcoin ETFs.

Bitcoin Needs To Break Weekly Resistance For New Highs

Even with solid demand zones beneath, Bitcoin’s path to new highs is not yet confirmed. Analyst Rekt Capital weighed in with his analysis, noting that Bitcoin is currently facing a strong weekly resistance band just under $109,000. Particularly, Bitcoin is at risk of a lower high structure on the weekly candlestick timeframe chart.

Rekt Capital noted that a weekly close above the red horizontal resistance line must be achieved in order for Bitcoin to reclaim a more bullish stance. That resistance, which is currently around $108,890, is acting as a ceiling for Bitcoin’s upward rally.

Related Reading

As such, Bitcoin would need to make a weekly close above $108,890 to position itself for new all-time highs. Unless there is a convincing break of that level, the price action of Bitcoin could be erratic and susceptible to a retracement to $106,000.

At the time of writing, Bitcoin is trading at $108,160.

Featured image from Unsplash, chart from TradingView